Government of Laos Tax Relief for Impact of COVID-19 Pandemic

May 7, 2020Although the Lao PDR has not experienced a severe impact from the COVID-19 pandemic, the Government of the Lao PDR (“GOL”) is taking it seriously and generously providing tax relief in order to minimize stressful impacts on employees and help out the affected micro-, small- and medium-sized enterprises in the country.

With issuance of the Decision on Policies and Measures to Reduce the Impact of the COVID-19 Pandemic on the Lao Economy No. 31/PM (2 April 2020), the Ministry of Finance issued Notices No. 1027 (10 April 2020), No. 1061 (22 April 2020), and No. 1128 (24 April 2020) to guide the implementation of the tax relief policies granted under the decision.

Key Measures

Personal Income Tax

Personal income tax applicable to general employees

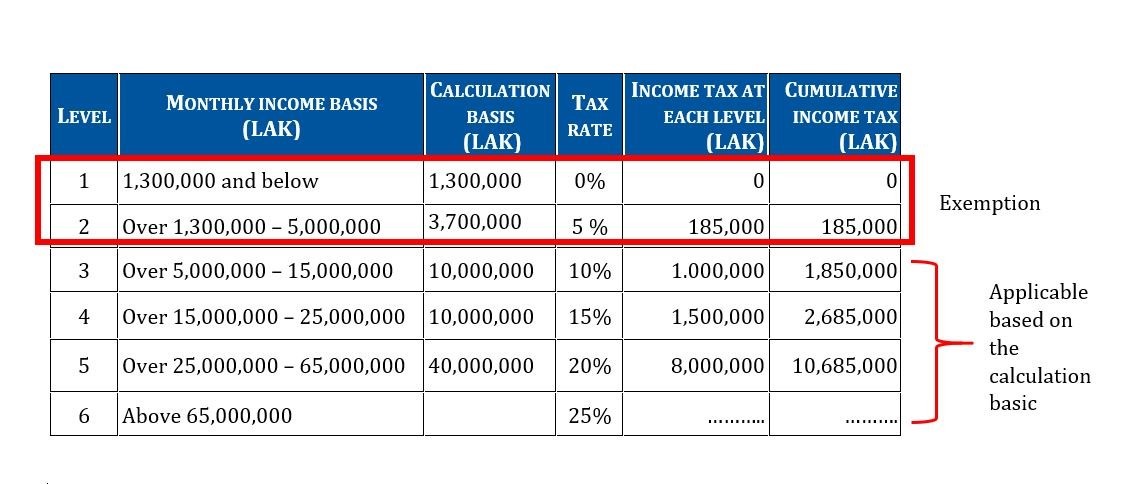

Any salaries in the amount of LAK5 million (approx. US$555) or less per month are exempt from personal income tax (“PIT”) for a period of three months – from April to June 2020. This means that, in accordance with the progressive PIT rate table under Article 39 of the Law on Income Tax No. 67/NA dated 18 June 2019 (“Income Tax Law 2019”), the monthly salary income basis at levels 1 (0%) and 2 (5%) are exempt from PIT. Salaries at level 3 and up will be subject to PIT at the relevant standard progressive rates per the below table:

The PIT for each of these three months must be declared and remitted to the relevant tax authority by the normal due date, i.e. 20 May, 20 June and 20 July.

The calculation method/formula in the TaxRis system will be updated to reflect the granted tax exemption during the three-month period.

PIT fixed rate under concession agreement

The exemption policy does not apply to employees who pay salary tax in a lump-sum amount or at a fixed rate in accordance with a concession agreement with the GOL, and thus, must follow the terms of the concession agreement.

Corporate Income Tax

All microenterprises falling under the scope of Article 29(2) of the Income Tax Law 2019 are exempt from having to pay income tax for the three-month period of April to June 2020. Microenterprises that have paid income tax in advance (for April to June 2020) have the right to carry forward the prepaid income tax amount to be deducted against any profits payable after June 2020.

Other taxes

Notice No. 1061 grants an exemption from penalties for a delay in tax payment of 0.1% and LAK500,000 per time in accordance with the Income Tax Law 2019, the Excise Tax Law, and the VAT Law for April to June 2020. However, it does not precisely state which taxes are eligible – it is understood that in addition to PIT, the other taxes to be declared on a monthly basis, value added tax (“VAT”) and excise tax are included.

The notice specifies that:

- The declaration and remittance of these taxes for April and May must be done no later than the end of June 2020.

- The declaration and remittance of these taxes for June must be done no later than the end of July 2020.

Any of these taxes that were not paid for January, February, or March 2020 will also be eligible for penalty exemption if they are paid by the end of May 2020.

However, in exchange for penalty exemption, any input VAT that is deductible and refundable during the exemption period will not be valid.

Unfortunately, any penalties that were paid before the Notice will not be eligible to the exemption.

If you have any concerns related to legal, tax, or accounting matters, or need more information on the above, please get in touch with your usual contact at the firm directly for a timely response.

KEYWORDS

RELATED EXPERIENCES

Related Articles

- The New 10% Value Added Tax Rate is Going to Be Effective Shortly! Are You Ready for It?

- April 26, 2024 - Presidential Edict No. 003/P Dated 19 March 2024 – VAT Rate to be Reset Back to 10% in 2024

- March 20, 2024 - The Lao Government Increases Excise Tax Rates

- October 23, 2023 - FY2021 Annual Submission and Dividend Income Tax

- May 24, 2022 - 2021 Amendment of the Tax Laws – Key Changes and Impacts

- January 12, 2022

This is single-publication.php